- I shopped using buy now, pay later service Afterpay for the first time.

- It was easy to set up and resulted in four lower payments than my initial bill with zero interest.

- While it was empowering to spend in a new way, having a middle-man can be stressful.

- See more stories on Insider's business page.

Back in 2008, in the midst of the Great Recession, the rapper T.I. released a song titled "Whatever You Like."

The track is a celebration of financial irresponsibility in the face of love; an ode to spending lavishly today without worrying too much about the consequences of tomorrow.

It's this song that played in a loop in my head as I embarked on my first foray into shopping using "buy now, pay later."

I shopped with Afterpay, an Australian financial technology firm that offers the ability to make a purchase and pay it off over time, also known as BNPL. Traditional retailers in the past have offered layaway – where the store held onto the item until you could pay it off – the retailers of today are willing to hand over the goods while you pay off the total price over time.

Afterpay has been around since 2018, and in August, it was acquired by payments platform Square for $29 billion in stock, a move borne out of what Square CEO Jack Dorsey described as "a shared purpose."

"We built our business to make the financial system more fair, accessible, and inclusive, and Afterpay has built a trusted brand aligned with those principles," Dorsey said at the time.

Afterpay says it now works with over 85,000 brands and boasts 14.6 million customers and counting. But it's one of a handful of BNPL companies, including Klarna and Affirm, competing for shoppers' dollars, and for good reason: the number of consumers turning to BNPL as a way to pay for their purchases is predicted to surge 81.2% in 2021, according to Insider Intelligence data.

With all that in mind, I decided to try BNPL myself.

The purchasing process

While I'd like to say I researched the merits of every BNPL provider before I began shopping, that's not the case - and I highly doubt that's how most users approach these services, either.

I decided to use Afterpay simply because it's partnered with Anthropologie, a company whose clothes, shoes, accessories, and housewares I really like and trust. Plus, knowing that Afterpay had recently been acquired by Square, I had a base level of faith in the service.

My decision to use BNPL was borne, like I'm sure it is for a lot of consumers, out of a desire to have new things combined with a desire to not spend a lot of money. I'm going on a 10-day vacation soon, the longest trip I've ever taken, and I needed some additional tank tops, dresses, and sandals for such a lengthy getaway.

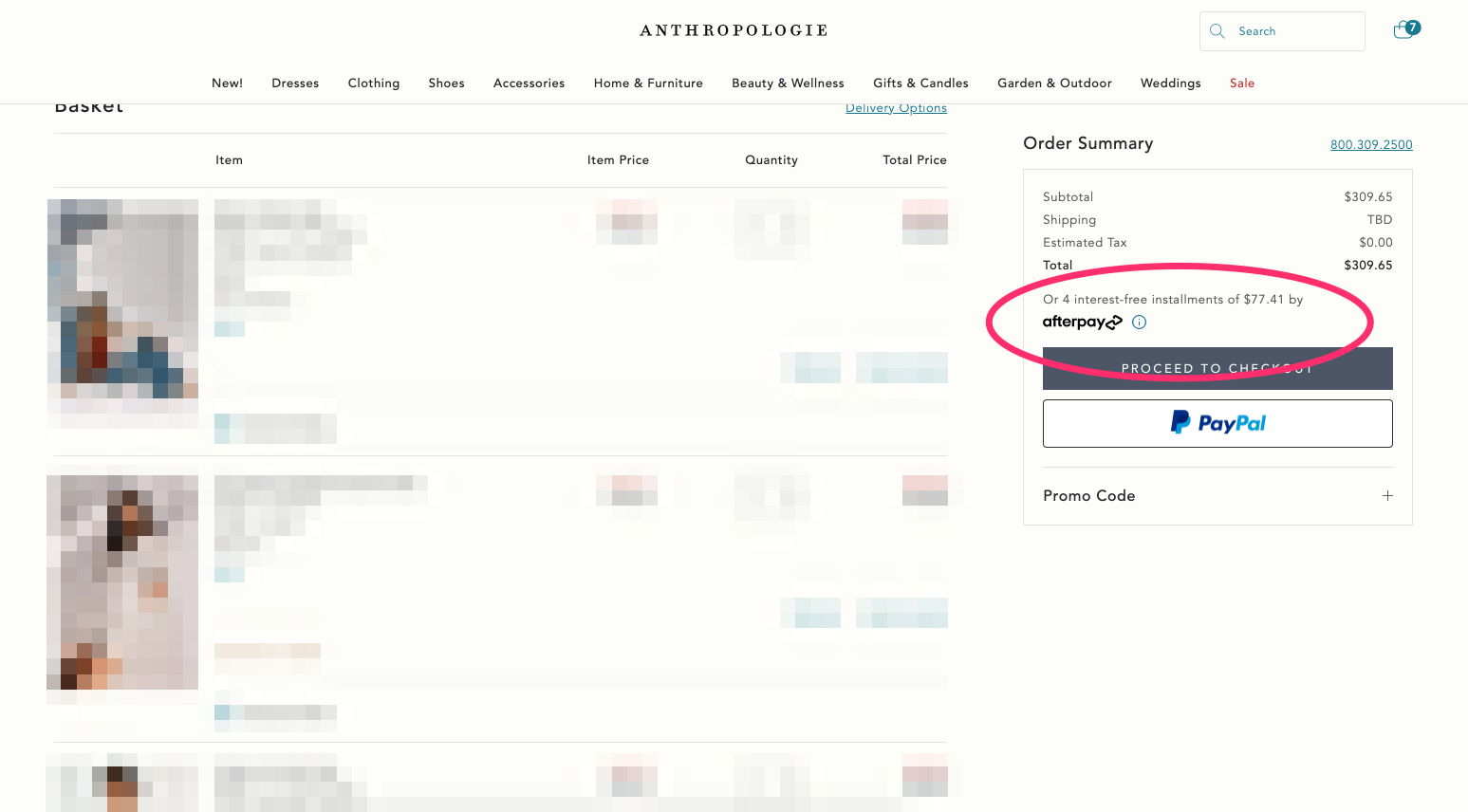

And so, after perusing Anthro's summer sale, I filled a cart with seven items that totaled $309.65.

When I was ready to check-out, the option to use Afterpay popped up - rather than pay for my purchases in a lump sum, it said I could pay it off in four interest-free installments of $77.41, a much more palatable amount on my credit card statement.

After I selected the Afterpay option, I was redirected to the company's website to finish my transaction. Once there, I entered my credit card information and agreed to Afterpay's terms, which stated that I was on the hook for the total payment with no interest. My first payment of $77.41 was due up front, with the next payment due two weeks after the fact, and the two subsequent weeks after that - all told, it would take six weeks to pay off the total bill.

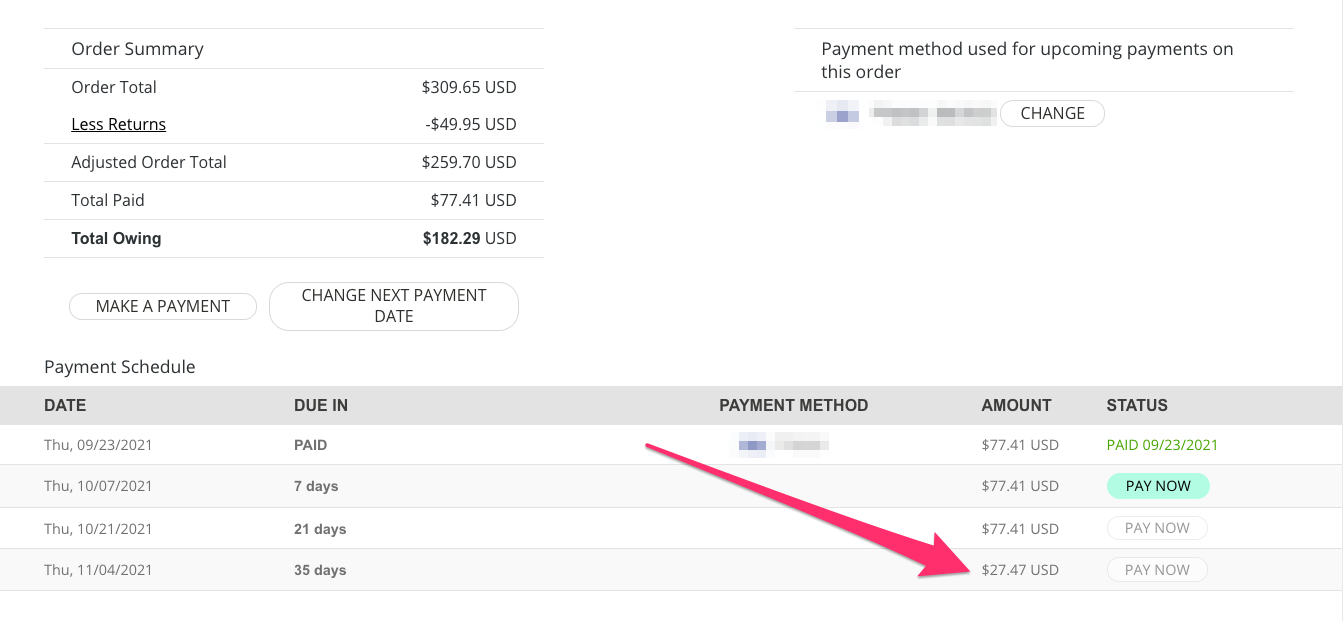

Afterpay set me up with a portal that showed my payment schedule and how much I still owe on that order, plus my spending limit, instituted by Afterpay: The platform will allow me to spend an additional $417.71, and promised that this limit will increase over time as I spend more and pay my purchases off on time, similar to a traditional credit card. If I choose to make more Afterpay purchases, they'll all be listed in this portal so I can keep track of my payments.

One thing that Afterpay makes very clear is that it can't handle returns for you, and I was nervous: If one of the items I ordered didn't work out, would I still be on the hook to pay Afterpay? The short answer is no, but only because I ordered from a retailer with a pretty standard returns policy - if I don't care for an item, I can return it to Anthropologie within 60 days and Afterpay will adjust my payments accordingly to account for the refund.

This ended up coming into play soon after I placed my order: One of the items I ordered ended up being out of stock and Anthropologie had to cancel it. Afterpay adjusted almost immediately, reducing my final payment to $27.47.

The upsides - and potential downsides

It's hard not to wonder if BNPL is too good to be true - there has to be some hidden catch, right?

And the fact is, there could be. Some BNPL services, though not all of them, will report missed payments to credit bureaus, which could result in a hit to your credit. You could also rack up late fees, and if you stop paying altogether, your account could be sent to collections, according to Investopedia.

Afterpay says it won't report a missed payment, mainly because most people don't spend a lot of money via the service.

"We don't believe in preventing people from accessing Afterpay because they may have had an old debt from a long time ago. And we don't believe that missing a payment with Afterpay should result in a bad credit history - especially when the average purchase is only around $150 (which may surprise you)," the company says.

Instead, Afterpay will charge you a late fee for missed payments, which starts at $10 and can go up to $68, or 25% of the total purchase price, whichever is less. It will also pause your account until you pay up.

To me, a late fee is preferable than paying interest, but I'm hoping it never comes to that, which is why I hunted around Afterpay's site for a way to set up automatic payments. I couldn't find one, so I asked Afterpay about it and it turns out, the payments are automatic without you having to set anything up.

A spokesperson for the company explained that the day before your payment is due, you'll get a reminder to check that you have enough funds for the transaction to go through. The next day, the payment will automatically be deducted from the card you have on file. While I'm relieved to hear that the payments are automatic, this could probably be a bit clearer for consumers.

A new way of spending

Afterpay, and BNPL services more broadly, are marketed as a way to provide more choice to consumers, to create a new form of financial freedom and give shoppers more purchasing power.

I have to admit that it felt momentarily empowering to be able to shop however I wanted, to spend in a new way - like the song says, "Go get it, I buy it." But what T.I. didn't rap about, and what's easy to forget, is that nothing is free. While BNPL is another option for consumers, it's also locking them into another financial relationship.

As someone who only has one credit card and doesn't take a lot of financial risks, having another bill looming over my head is actually starting to stress me out a little bit - part of me wonders if I'll just end up paying up ahead of time, which the Afterpay spokesperson told me is very common among its customers.

And while it's nice to be able to avoid one large payment, I'm certainly not saving money - I'm just tricking my brain into thinking I am. In fact, I probably spent more than I would have normally because the initial payment seemed comparatively small.

For me personally, BNPL seems like the perfect option for larger purchases like, say, a new piece of furniture, since it alleviates sticker shock. But for now, for those everyday purchases, maybe it's better that I don't have whatever I like.